Meet The Team

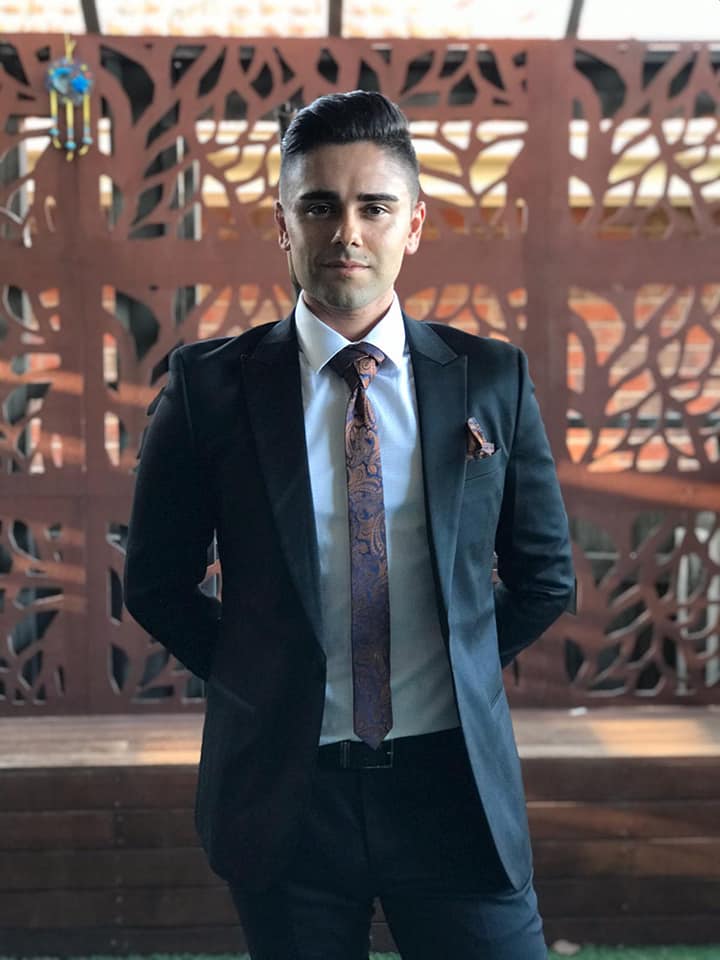

Christopher Borg – The Director

Borg Financial founded in 2019 by Christopher Julian Borg, a company representing a high level of prestige within the finance industry.

Since starting in the mortgage broking world in 2012, Chris has worked in prominent finance firms. Having dedicated 3 years within National Australia Bank, learning from the best of the best, Chris has consolidated his learning and commenced the start of a legacy.

Borg Financial whilst still in its infancy stems to lead with a technological advantage, working with Specialist Finance Group’s main platform, exceeding industry standards. Looking beyond the horizon, Borg Financial is full steam ahead.

Shaun Lynch – Commercial Broker

Shaun is a commercial broker here at Borg Financial. Having 13 years under his belt at a major bank, with the last 7 years in business banking working as an analyst, then moving into business retention and portfolio managing. Whilst predominantly a commercial broker Shaun can also assist you with car loans, asset finance for your business, residential loans, mixed lending business and personal as well as private lending. Shaun is also an avid fitness trainer, he enjoys lifting weights, Muay Thai and swimming daily. If you have any questions please reach out, I am happy to discuss any potential loans or questions you may have.

Daniel Dadrasan – Client Support Liaison

Daniel is new to the finance industry, and has commenced as a client support liaison with Borg Financial. Currently studying in RMIT for his Diploma in Mortgage Broking. Daniel strives to be exceptional, learning the ways of finance and commence in a rich career of broking and portfolio management. Daniel has positive attitude towards all things in life and is eager to meet you as a client of Borg Financial. If you have any requirements or questions regarding your finance Daniel will strive to assist you.

Siva Ilancheran – Residential Broker

With over 8 years of experience across major banks and a mortgage management firm, Siva brings a wealth of knowledge and expertise to her role as a residential broker at Borg Financial. Her transition into mortgage broking was driven by a genuine passion for helping people achieve financial security and build long-term wealth through strategic property investment. Siva specialises in tailored mortgage solutions and strategic loan structuring, helping clients grow their property portfolios. She builds lasting relationships, offering guidance at every stage of the financial journey. While her focus is residential lending, Siva also assists clients with SMSF loans, reverse mortgage lending, commercial, car loans as well as private funding solutions. Originally from Singapore, Siva enjoys travelling, meditation, interior styling, and small-scale renovations. So, whether you’re exploring your next investment or seeking clarity on your finance options, Siva is here to help and can also communicate in Tamil.

Darae Jung– Administrator

With a background in hospitality and small business ownership, Darae brings a personal and service-focused approach to assisting our mortgage brokers. Originally from South Korea, she moved to Australia as an international student and has since become a proud Australian citizen. Her journey—from student to migrant, to business owner and now finance professional—not only inspires the way she supports her clients, but is also an experience that shaped her deep understanding of the financial challenges and dreams of everyday Australians.

Having successfully run her own café in Melbourne, Darae is well known and respected among local residents, small business owners, and her broader community. She is also an active member of Melbourne’s Korean community and local church network, where she continues to build meaningful relationships and serve others with compassion and integrity.

Darae continues to learn and assist our brokers in home loans, car loans, and personal loans, where we off tailored financial solutions to individuals and families. She understands that every client’s situation is unique and approaches each case with care, clarity, and commitment and with dedicated support to the team.

Ruby Aujla – Financial Planner

Ruby Aujla is a Financial Adviser and has been in the financial planning industry since 2015. Ruby opened her own practice in 2019 called RA Financial. She learnt the ropes from a young age and grew up passionate about helping people with their finances and making a difference. The main thing is providing guidance and support to alleviate financial stress. In 2021 Ruby aligned RA Financial with Borg Financial.

Ruby has always been passionate about assisting people with their finances and mainly reducing finance stress. To provide that service to her satisfaction, she started her own financial planning business to be able to further help more clients without restrictions, such as providing pro bono advice for clients in Financial Hardship and Terminal illness.

Ruby also brings unique experience in a niche area of QROPS/UK Pension advice, which not many advisers are qualified for. Being able to look at clients’ overall financial health is important and it may be for clients who have previously lived overseas and have assets offshore. Ruby is a true advocate for her clients, ensuring that advice is tailored to best meet (and ideally exceed) their goals in the most efficient way.